Marathon Petroleum Confirms Speedway Spinoff, Announces Leadership Changes

FINDLAY, Ohio — After a 10-month strategic review process, Marathon Petroleum Corp. (MPC) is spinning off Speedway LLC.

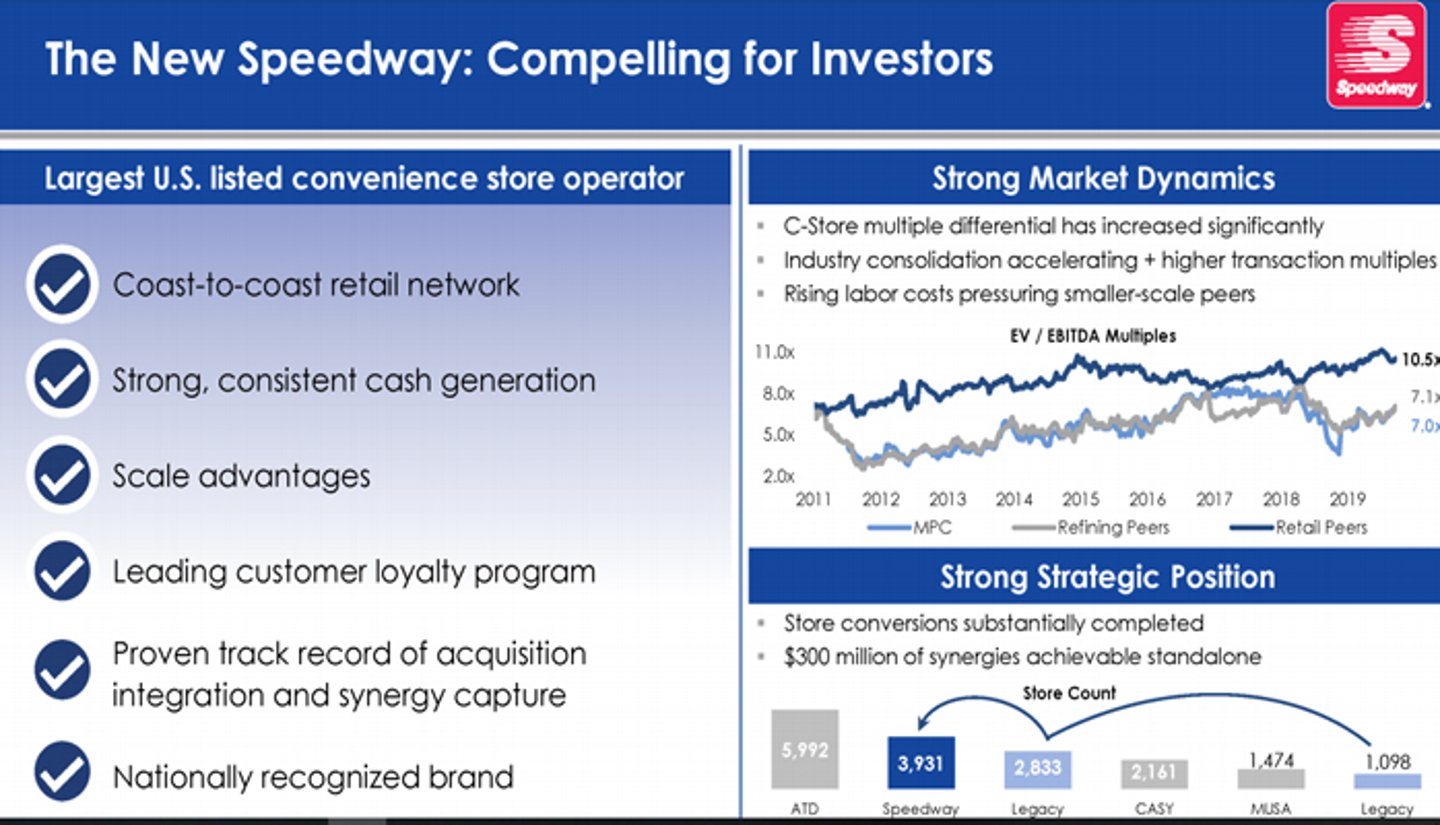

The retail network will become an independent company by year-end 2020. Upon completion of the spinoff, Speedway will be the largest U.S.-listed convenience store operator "boasting a coast-to-coast retail network and a nationally recognized brand," MPC Chairman and CEO Gary Heminger said during the company's third-quarter earnings call on Oct. 31.

The energy company kicked off the strategic review in January following MPC's tie-up with Andeavor. That transaction closed on Oct. 1, 2018, creating a coast-to-coast retail powerhouse.

"Over the past year, our primary operations focus has been integrating our two businesses, enabling us to execute and achieve our targeted synergies. Consistent with our continued focus on transforming our business to deliver shareholder value, beginning in January this year, we embarked upon a strategic review process to identify the next steps in our value creation process," Heminger explained.

This review included involvement from MPC's board of directors and engagement with financial and other advisors. Throughout the process, the company also gathered shareholder feedback.

"As a result of that review, today we announced our most recent step to create shareholder value and that is our intent to separate Speedway into an independent company," Heminger said. "The board and our management is fully committed to pursuing the path that maximizes shareholder value, and we believe this separation will create two strong, industry-leading companies well positioned for long-term growth and success."

Under the plan, the new Speedway will consist of all of MPC's company-owned and company-operated convenience stores — which collectively generate $1.5 billion of annual EBITDA.

"We believe this business has strong growth potential, fueled by a strong, loyal customer base," Heminger explained.

MPC will retain its direct dealer business, which primarily operates on the West Coast. This separately managed business within the retail segment is only fuel supply with no merchandise sales, he noted.

"As we look ahead, we are truly excited about the opportunity the separation presents to each company to unlock value and drive total shareholder return," the chief executive said. "We believe this transaction has significant benefits for both MPC and future Speedway shareholders, and has the potential to create an enterprise value of approximately $15 billion to $18 billion."

One of the key drivers behind the spinoff decision, according to Heminger, was the recent growth in Speedway's scale and earnings power.

"The number of stores has nearly tripled since 2011 to roughly 4,000 and the membership within our Speedy Rewards loyalty program has nearly doubled," he noted.

Speedway has been a consistent top-tier performer in the c-store industry. Historically:

- Speedway has had industry-leading same-store merchandise growth and fuel margins;

- It's led the industry in profitability on a per-store basis; and

- It's built a platform to deliver a strong earnings growth trajectory and exceptional pre-cash flow conversion, which will support continued investment as a standalone company.

As part of the separation process, MPC will establish a long-term, market-based supply agreement with Speedway, which will remain headquartered in Enon, Ohio.

In addition to the Speedway spinoff, MPC has created a special committee to review midstream alternatives, Heminger reported, adding that "unlocking value within the midstream is more complex than the separation of Speedway."

Among the potential midstream alternatives are asset and business divestitures. MPC hopes to complete the review process by its first-quarter 2020 earnings call.

LEadership Changes

MPC also announced several leadership moves, including Heminger's decision to retire after the first quarter of 2020. He has served as president and CEO of MPC since the company's spinoff from Marathon Oil in June 2011, and as chairman and CEO since 2016. He has also served as chairman and CEO of MPLX GP LLC since 2012.

The board appointed a committee to consider internal and external candidates to succeed Heminger. A nationwide search is underway.

In addition, Greg Goff, executive vice chairman of MPC and a member of the boards of MPC and MPLX's general partner, will retire effective Dec. 31 of this year. Goff joined MPC after its strategic combination with Andeavor in October 2018.

Michael J. Hennigan, current president of MPLX GP LLC, has been appointed CEO of the same organization, effective Nov. 1. Frank M. Semple will succeed Goff as a member of the MPC board.

Findlay-based MPC operates the nation's largest refining system with more than 3 million barrels per day of crude oil capacity across 16 refineries. MPC's marketing system includes branded locations across the United States, including Marathon brand retail outlets. Speedway LLC, a MPC subsidiary, owns and operates retail convenience stores across the U.S. MPC also owns the general partner and majority limited partner interest in MPLX LP, a midstream company that owns and operates gathering, processing, and fractionation assets, as well as crude oil and light product transportation and logistics infrastructure.